Crypto Swing Trading: Low Risk aur Tax Benefit ke Saath Paisa Kaise Banayein?

1. Market Volatility aur Foundation (Why is Crypto so volatile?)

Why is Crypto so volatil

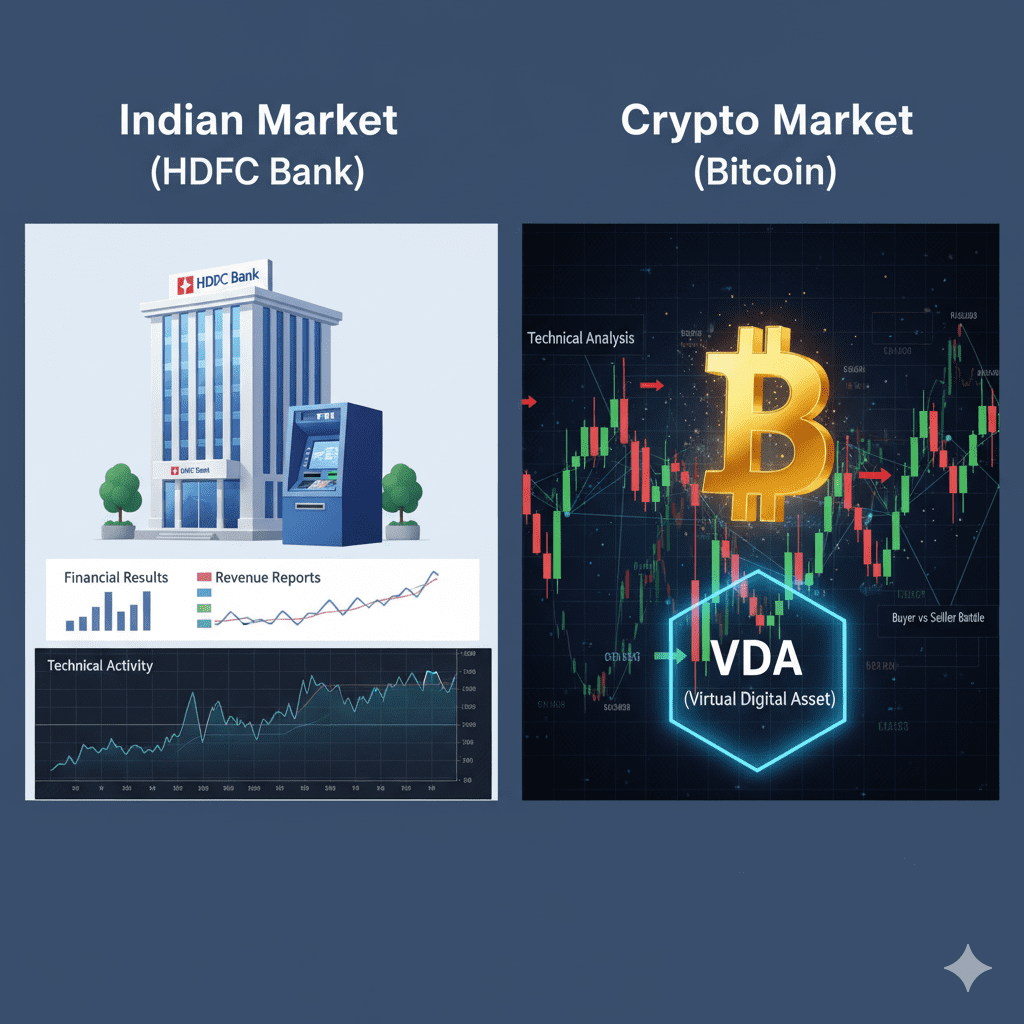

- Indian Market (HDFC Bank): It has a Fundamental (business results, physical presence) and a Technical basis.

- Crypto Market (Bitcoin): It is a Virtual Digital Asset (VDA). It has NO Fundamental basis. The entire game is based on Technical analysis and the constant battle between Buyers and Sellers, causing high Fluctuation. “Trading”

- COINDCX Join Now

2. Coin Buying vs. Swing Trading (The Tax Advantage)

| Feature | Investing (Direct Coin Buy) | Swing Trading (Via Futures) |

| Investment Style | Amount = Position (No Leverage) | Amount = Leverage (e.g., 200X of Position) |

| Maximum Loss | Total Amount Invested (If the coin goes to zero) | Only the Used Margin (A fraction of your capital) |

| Tax Benefit | NO (Tax on long-term holding) | YES (Can be treated as Trading/Future Holding for tax benefits) |

3. Best Strategy: Risk-Reward (R:R) Basis

- Preferred Method:Reward to Stop Loss Basis

- Stop Loss (SL): If the position hits -30% loss, CUT the position.

- Reward (TP): If the position hits +30% profit, CUT the position and book profit.

- Why R:R is Better (Money Rotation):

- Cryptocurrency has a fast Money Rotation cycle. Coins give huge returns and then quickly Dump as money flows out to other assets (Gold, Stable Coins, or other Altcoins).

- Rule: “Paisa Kamao aur Niklo” (Make money and exit). Don’t hold indefinitely like an HDFC Bank share, or your profits might vanish due to market correction.

4. The Master Key: Leverage (The Weapon)

Leverage is the main reason we do crypto/forex trading.

| Benefit | Description |

| Bigger Position | Leverage means a investment acts like a position. |

| Capital Protection | Only the Used Margin is at risk. The remaining capital is safe for your next trade. |

5. Step-by-Step Swing Trading Strategy

If you are doing Swing Trading, always use Perpetual Futures on a Govt. Registered Platform (like Mudrex) for the leverage benefit.

A. Leverage Limit (Over-Leveraging se Bachein!)

- Blue Chip Coins :

- Maximum for Scalping:

- For Swing Trading: (This is sufficient)

- Mem/Alt/Utility Coins: Strictly limit leverage to.

B. Portfolio Diversification (Sirf BTC/ETH nahi!)

Your portfolio must be Diversified to minimize risk and capture opportunities from different sectors:

Why is Crypto so volatil

- Blue Chip Crypto:

- Altcoins:

- Mem Coins:

- DeFi Tokens

- Utility Tokens

- The Golden Rule: When the market is in the Disbelief Zone (everyone is panicking/crashing), BUY. When it hits the Euphoria Zone (everyone is buying), PROFIT BOOK.

One thought on “Market Volatility aur Foundation (Why is Crypto so volatile?)”