What do I think will happen? Well, I’ve got a bear case and a bull case?

https://www.effectivegatecpm.com/mkctbpv1vq?key=d338856cee491349c9c087e6c52d7c45

Here’s my macro Bitcoin forecast. It’s 21 years. Big news happening in crypto today. I want to play you a video clip, Michael Saylor talking about Bitcoin.

What do I think will happen? crypto biggest gainers Well, I’ve got a bear case and a bull case. I want to update you on everything going on with Wall Street and Ethereum.

One of the things you’ve been saying is you think that the Ethereum network or market cap is going to flip with Bitcoin. Big Solana news today.

Solana is going to have the most powerful, the fastest transaction and execution layer on Earth. We are going to move from a mere blockchain to something more akin to a global supercomputer. Crypto News A shared state.

A computer in which anyone can access, which it will be permissionless, and it will be faster than the NASDAQ, faster than Visa, faster than MasterCard.

And different lower cap altcoins I need to get on your radar in general. There will be a token.

There will be an airdrop. You’re arguably one of the most mainstream crypto projects there is. Smash the like button. Let’s start here. Cryptocurrency

Breaking news. JP Morgan, the infamous JP Morgan, will finally allow Bitcoin and Ethereum as collateral.

Just last year, CEO Jamie Dimond was calling Bitcoin a Ponzi scheme. Again, we’ll cut to 2025.

They’re accepting Bitcoin and Ethereum as collateral from institutional clients. Things change quickly.

If you mean crypto like Bitcoin

Crypto. If you mean crypto like Bitcoin, I’ve always said it’s a fraud. So no hope for it. Well, it’s a Ponzi scheme.

It’s a public decentralized. The info that you need to know is as follows:

JP Morgan Chase plans to permit institutional clients to use Bitcoin and Ethereum holdings as collateral for loans by the end of the year.

This is part of a broader push by Wall Street to dive deeper into crypto.

This program by JP Morgan Chase will be offered globally.

Now, previously, you’re aware this is not their first foray. The bank has already taken steps to integrate crypto into its core lending operations.

Also earlier this year, JP Morgan began accepting ETFs, crypto linked ETFs as collateral.

And now they’re finally doing the real assets.

Why Only Ethereum? How Trust Trumps Speed for TradFi

This is the biggest takeaway to me. This change could make liquidity against long held crypto positions easier to access for institutions that prefer not to sell.

They’re literally setting up the products and services to make it so institutions in Wall Street don’t have to sell. For JP Morgan, this move is both symbolic and functional.

The bank, whose CEO Jamie Dimon once dismissed Bitcoin as a money laundering tool and worse than tulip bulbs, has steadily pivoted as client demand and regulatory clarity have increased.

Like this is incredibly bullish and is sending a message to every other financial institution on Wall Street.

Ethereum Flips Bitcoin Narrative: Why TradFi’s $300B RWA Play Prefers Trust Over Speed

This is incredibly interesting because we’re seeing Wall Street dive so heavily into Bitcoin, yes, but so much more into Ethereum.

With Standard Charter, Jeffrey Kendrick, Global Head of Digital Asset Research from Standard Charter, just put out a report that said tokenized real world assets will grow from

$34 billion today to $300 billion over the next 12 months. All of this growth will happen on Ethereum because TradFi trusts Ethereum.

Quote, it is irrelevant that other chains are faster or cheaper. Ethereum has been around for over 10 years and has never gone down.

For TradFi, trustworthiness trumps marginal speed and cost savings every day of the week.

So it is no wonder we’re seeing metrics like this. New milestone, Ethereum surpasses Bitcoin in percent of total supply held by digital asset treasuries.

So look at this. Ethereum treasury entities now own 4% of total ETH supply, overtaking Bitcoin at 3.6% plus Ethereum staking yield,

L2 adoption and tokenization. Serious money seems to prefer Ethereum. Momentum likely continues. Incredibly interesting times.

So think to yourself and realize how the narrative of Ethereum as an investable asset is changing. We’re seeing the Ethereum narrative change in real time.

So what happens to the perception of ETH as a store of value when the market realizes ETH has lower inflation than Bitcoin plus staking rewards?

What happens when $50 billion ofEthereum floods into staking from institutional ETF products? It sounds crazy, but it’s possible for this to happen over the next year or so.

You know, ARK Invest’s Cathie Wood doesn’t think that Ethereum will ever flip Bitcoin. She’s bullish on them both, but Bitcoin more. Tom Lee, bullish on both Bitcoin and Ethereum.

He thinks Ethereum will flip Bitcoin. This is 60 seconds of him trying to convince Cathie Wood that Ethereum will flip Bitcoin. Listen to this.

One of the things you’ve been saying is you think that the Ethereum network or market cap is going to flip with Bitcoin.

Well, if I could rewind a little bit to 1971. In our chairman’s message last month, we addressed how gold versus Wall Street grew post-1971. So 1971 was when Nixon formally withdrew the US from the gold standard.

In 1971, the dollar became fully synthetic because it was no longer backed by anything. So there was a risk that the world would go off the dollar standard.

So in stepped Wall Street to create products, propagate the future of Wall Street, from money market funds to credit to mortgage-backed securities to futures.

And dollar dominance by the end of that period went from 27% of GDP terms, but to 57% of central bank reserves and 80% of financial transaction quotes.

And the market cap of equities today is 40 trillion compared to 2 trillion for gold. So in other words, gold is 5% of all available assets.

And so in 2025, as we move not just dollars onto the blockchain, which is stablecoins, but we’ll move stocks and real estate, dollar dominance is going to be the opportunity of Ethereum.

So digital gold is Bitcoin. And so in that world, we believe Ethereum could flip Bitcoin similar to how Wall Street and equities flipped gold.

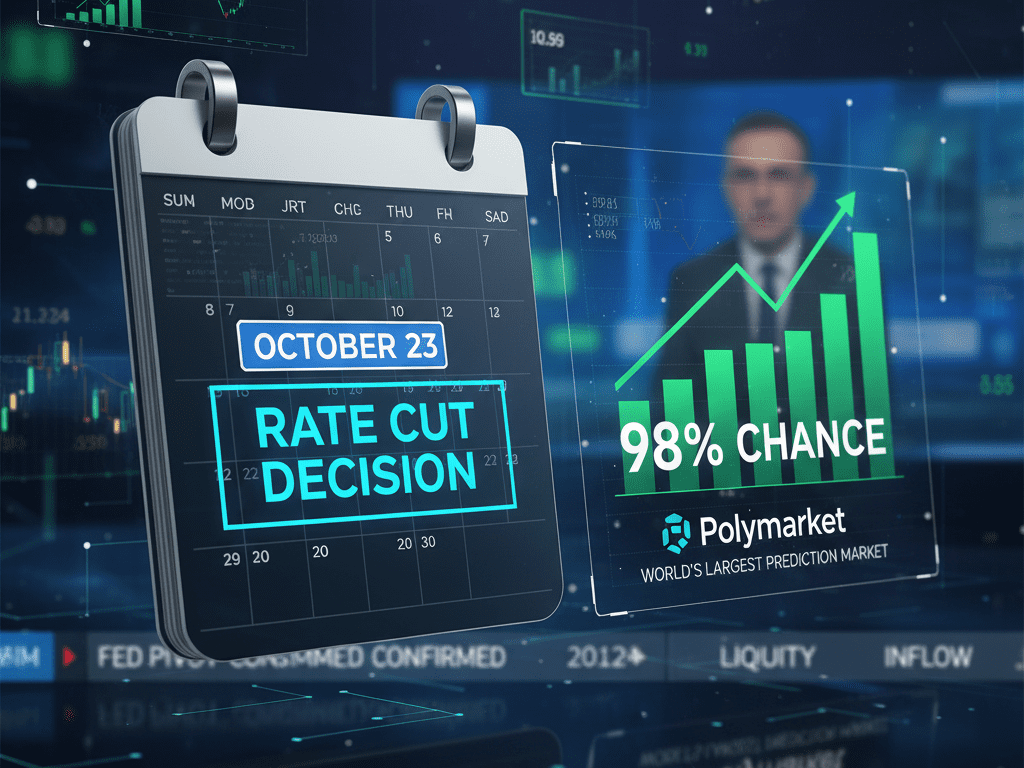

98% Chance of Rate Cut: How Polymarket’s Accurate Predictions Confirm the Fed Pivot

Another huge catalyst on the horizon, rate cuts. There is a 96.7% chance a rate cut happens next week.

Meaning QT is ending soon, liquidity is turning, and the Fed pivot finally confirms all of this. You know what this means.

How are you playing this? Even Polymarket, which tends to be very accurate, this is the world’s largest prediction market, puts odds at 98% chance we see an October cut next week.

If you’re unfamiliar, Polymarket is the world’s largest prediction market, allowing you to stay informed and profit from your knowledge by betting on future events across various topics.

Did you know that studies show that prediction markets are often more accurate than some random talking head on the news because they combine news and polls and expert opinions into a single value that represents the market’s view on the event’s odds?

Polymarket reflects accurate, unbiased, and real-time probabilities for the events that matter most to you, and all of this leading to a big announcement from our channel.

We have partnered with Polymarket and will now be sourcing Polymarket data to bring accurate predictions to you.

Now, one of the reasons why Polymarket shines leagues above the rest is because of their crypto component. They’re a native crypto company.

In some of the recent news, MetaMask, the world’s largest wallet provider, is partnering with Polymarket. They are becoming multi-chain as well, just recently adding BNB deposits and withdrawals to its platform.

Even expanding into stocks, Polymarket launches up-down equity markets, letting users bet on stock prices.

And the news today, and I wanted to bring you this first, Polymarket to launch their own native token. Now, people who use Polymarket, like us and our audience, are probably eligible for a future airdrop.

Their CMO, Matthew Modabber, says there will be a token, there will be an airdrop. We are arguably one of the most mainstream crypto projects there is. Listen to this. There will be a token.

There will be an airdrop. And look, I think, you know, like we really pride ourselves on being the most thorough company we hope to be in the world, right? And when we do something, we want to do it really well.

And I feel like, you know, obviously we could have launched a token whenever we wanted. And it’s just how thorough we want to be about it.

Like, do we want it to be a flash in the pan or do we want it to be a token with true utility, longevity, and it to be around forever, right? And that’s what we expect from ourselves. And that’s what I think everyone in the space expects from us.

You know, we are the most, arguably one of the most mainstream crypto projects there is.

The $49 Million Bitcoin Bull Case & Solana’s ‘Global Supercomputer’ Onboarding Wall Street

Jumping back into Bitcoin. Slow and steady wins the race. This is the first cycle where truly nobody believes that Bitcoin is going away. Nobody believes the US government is going to take it away.

China will take it away. Everybody pretty much knows that Bitcoin will be here 10 years from now, 20 years fromnow.

Kind of like in 1995, people in the internet, they were not sure in 1995 whether the internet would be a part of their daily lives forever, cut to 2005, they were sure of it.

years into Bitcoin this year, and people are damn sure Bitcoin will be a part of their daily lives.

And for those who didn’t see it, here’s Michael Saylor saying his bull case for Bitcoin is $49 million by 2045. Here’s my macro Bitcoin forecast. It’s 21 years.

It goes out to the year 2045. What do I think will happen? Well, I’ve got a bear case and a bull case. But what I think will happen is that 55% ARR goes to 50%, 45%, 40%, 35%, 30%, 25%, 20%.

It’s between 50 and 20. It’ll gradually decelerate till it’s growing about twice as fast as the S&P index.

And at that rate, Bitcoin’s $13 million a coin in the year 2045. $13 million. It could be a $3 million bear case. It could be a $49 million bull case.

But what is Bitcoin? 7% of the world’s assets then.

What about the rest of the assets? Well, I actually think that AI’s and technology are going to revolutionize tech. We had no companies worth a trillion. Then we had a bunch of trillion dollar companies.

You’re going to see more because you’re going to see companies with 100,000 AIs and no employees. And they’re going to do the work of companies that used to have 100,000 employees.

You’re going to see mega corps develop shipping robots and self-driving cars and a company that gives a personal physician to a billion people without any doctors on the payroll.

So clearly equities are going to grow fast. Gold is going to get demonetized. Land will be less monetized. But look, here’s the future in 2045. It doesn’t look that revolutionary. It looks like today.

Let’s talk about Fidelity. And this is a microcosm for how all traditional financial institutions are now adopting Bitcoin and crypto.

So, you know, Fidelity multi-chain, like a lot of them nowadays, Bitcoin, Ethereum, Litecoin.

And the news today breaking Fidelity, the asset manager with 5.8 trillion in assets under management, makes Solana accessible for all U.S. brokerage customers.

So they’re onboarding both crypto ETFs and the native assets themselves. Yes, Fidelity, one of the world’s largest asset managers with some 6 trillion AUM is now offering spot Solana trading in custody.

Also now educating everyday investors on Solana.

We are quickly heading down the path where investors can own spot crypto right along usual TradFi investments.

This is so bullish for the future. Solana is going to have the most powerful, the fastest transaction and execution layer on Earth.

We are going to move from a mere blockchain to something more akin to a global supercomputer, a shared state, a computer in which anyone can access, which it will be permissionless and it will be faster than the NASDAQ, faster than Visa, faster than MasterCard.

And when you factor in T plus one settlement, it’s already faster. You’re going to see Solana have 20 millisecond block times, multiple concurrent leaders.

You’re going to see Solana producing and executing consistently a million transactions per second. And that’s not going to be just speed for speed’s sake.

It’s going to mean that Solana is going to be not just competitive with the NASDAQ, but it’s going to be something that the NASDAQ might want to build on top of.

And so we think that the markets will converge. DeFi will look more like CeFi.

DeFi will look more like TradFi in many ways, but maintain its core characteristics because those are inherent to trading on a decentralized network.

My name is Aaron at Altcoin Daily. Subscribe to our channel. I’ll see you tomorrow.