🇺🇸 The Federal Reserve’s Curveball Sends the Crypto Market Tumbling

I. The New Stressor: The Federal Reserve‘s Rate Cut U-Turn

It seems we can never catch a break. We had just celebrated the positive news from the Trump-Xi meeting, but the crypto market has been hit by a new shock—a curveball thrown by the Federal Reserve.

Shutterstock

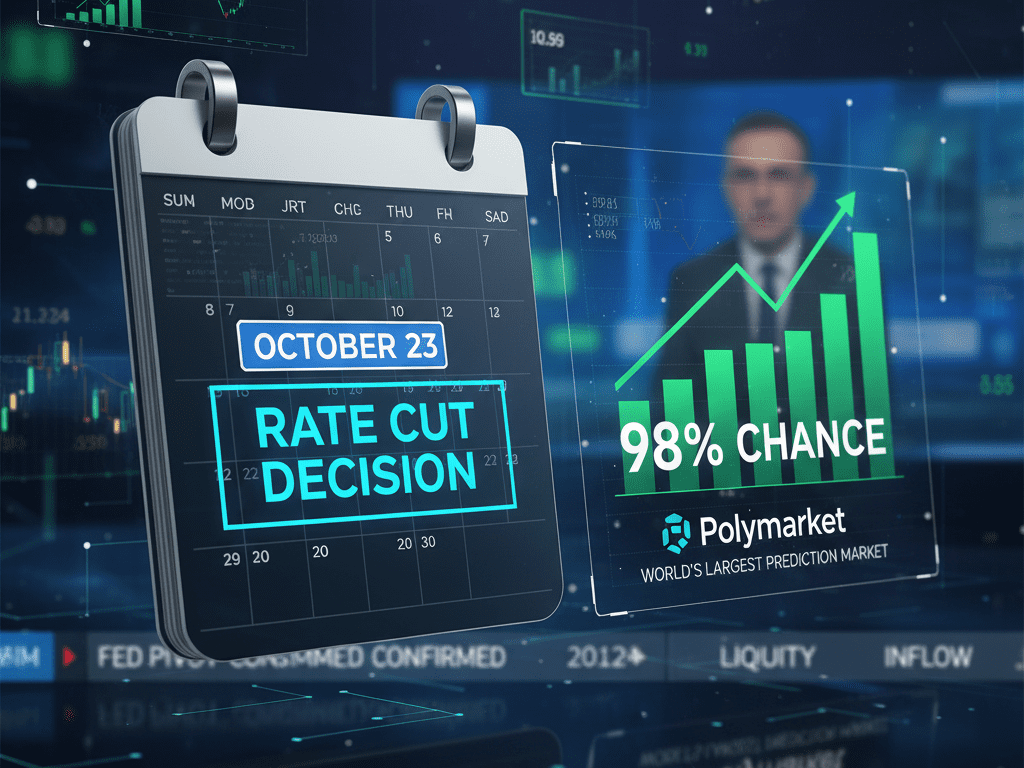

Crypto consistently moves in response to global macro events, and this time, the cause is the Federal Reserve‘s latest announcement. The entire crypto market is currently in a “quasi freefall.” The Federal Reserve had previously indicated it would deliver another interest rate cut, particularly in December, but has now reversed course.

II. Trump-Xi Meeting Success vs. Federal Reserve Impact

The Trump-Xi meeting was highly positive, with both sides agreeing to a one-year truce and various concessions. This good news removed one major impact point stressor (the trade war fallout) from the crypto market.

However, the Federal Reserve‘s decision not to reduce the interest rate significantly impacts crypto. Higher interest rates mean that borrowing and lending will continue at elevated levels, affecting overall market liquidity.

Though some argue that the small 25 basis points rate cuts haven’t yet reduced mortgage rates, the cumulative effect requires continuous rate cuts. The Federal Reserve‘s “Nope, not in December” stance is why the whole market is now panicking.

III. Market Reaction and Current Crypto Prices

The entire crypto market is reacting severely to this Federal Reserve scenario:

- Bitcoin (BTC) is trading around $107 (at the time of the article’s recording).

- Ethereum has dropped below $4,000, down 5%.

- XRP is down 6.5%, with most other assets falling between 6 to 10 points due to the Federal Reserve‘s announcement.

While the stock market showed mixed results (Dow up, NASDAQ down), the crypto market is clearly decoupled from the stable part of the stock market and is falling dramatically because of this sudden Federal Reserve curveball.

IV. The Long-Term Bull View and Opportunity

From a long-term perspective, the positive outcome of the Trump-Xi meeting is good news. However, we must now deal with the Federal Reserve’s change in policy.

As a long-term buyer and holder (long term bull), I view this short-term issue not as a disaster, but as an opportunity. While the fall is frustrating, it allows for “adding to the bag” (increasing investment) at lower prices. This current volatility is simply a short-term reaction to the Federal Reserve’s unexpected move.

Keywords used (aggressively placed): Federal Reserve, crypto market, interest rate cut, interest rate, Trump-Xi meeting, Trump and Xi, curveball, crypto, global macro events, borrowing, lending, rate cuts, Bitcoin, Ethereum, XRP, stock market, stability, decoupled, long term bull, long term buyer, opportunity, devalue.

Whoa! This blog looks just like my old one! It’s on a completely different topic but it has pretty much the same layout and design. Excellent choice of colors!