💎 The Foundation, Not the Hype: 3 Most Reliable Altcoins for 2025-26

Introduction

While the crypto market is often perceived as inherently risky—and rightly so—it’s crucial to distinguish between fleeting hype and solid foundational projects. Not all altcoins are created equal. Some are built on genuine innovation and real-world utility. This article breaks down three of the most reliable altcoins based on their fundamental strength: Cardano (ADA), Solana (SOL), and Binance Coin (BNB).

We will evaluate these coins on key parameters and, by the end, provide a mega-table comparing them to traditional assets like Stocks, Mutual Funds, Gold, Silver, and ETFs to help you understand the real logic behind crypto investing.

1. Understanding the Anatomy of a Reliable Altcoin

A reliable altcoin is one with a vibrant project lifecycle, an active ecosystem, and a clear future roadmap. They grow through rigorous development and research, not mere speculation. We evaluate reliability using five core parameters:

- Real-World Use Cases (RWC)

- Developer Activity (DA)

- Community Strength (CS)

- Roadmap Clarity (RC)

- Regulatory Safety (RS)

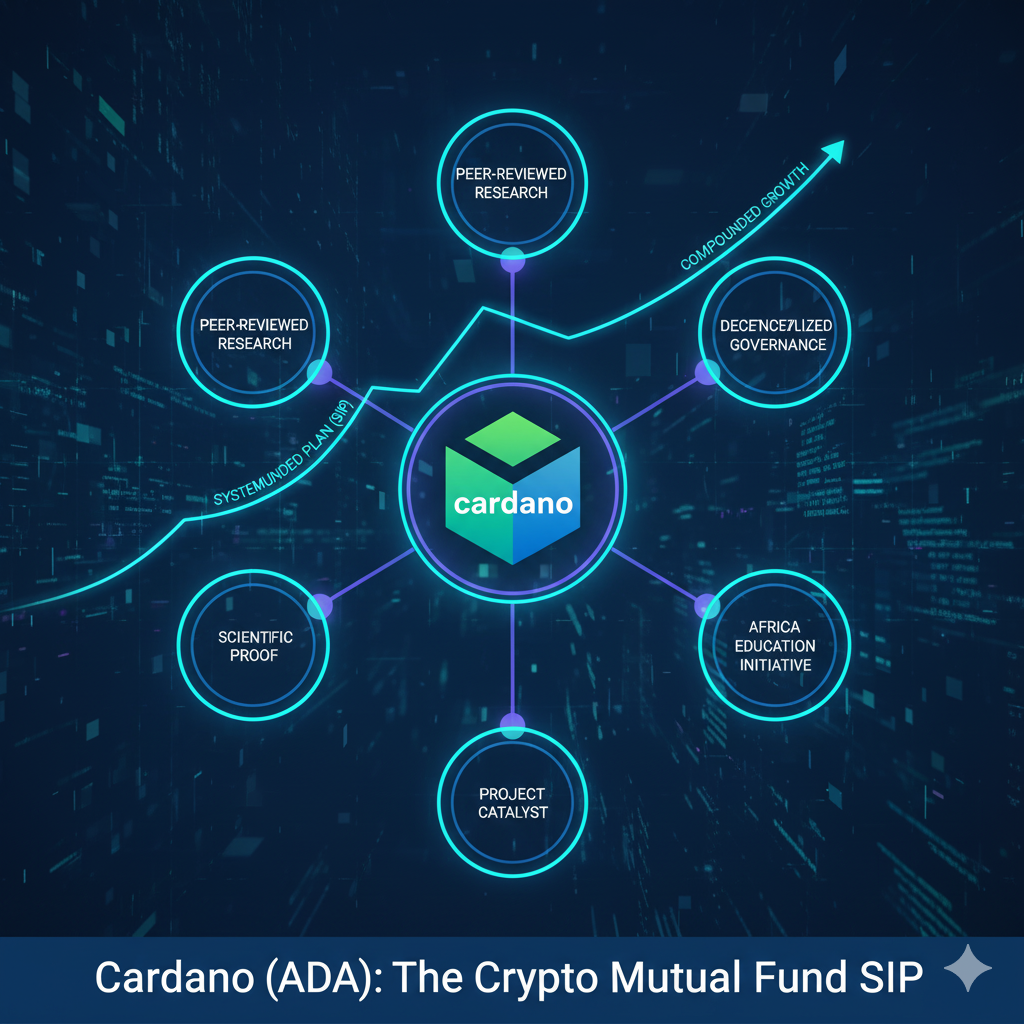

2. Cardano (ADA): The Crypto Mutual Fund SIP

Cardano operates with the diligence of a seasoned academic. Founded by Ethereum co-founder Charles Hoskinson, Cardano’s philosophy prioritizes peer-reviewed research and scientific proof before any release. This makes its foundation exceptionally strong, even if its development seems slow.

The Core Philosophy and Ecosystem

Cardano’s journey is divided into five eras: Byron, Shelley, Goguen, Basho, and Voltaire, each focused on incremental decentralization and innovation. The Project Catalyst acts as a community-run fund, allowing proposals for new projects, such as decentralized mutual funds for innovation.

Real-World Impact and Future Prospects

Cardano’s utility goes beyond speculation, with significant use cases in Africa, particularly in education and identity systems. This is not just a coin; it’s a real-life blockchain infrastructure.

While slow during bear markets, the discipline required to hold ADA is rewarded, much like an SIP (Systematic Investment Plan) in mutual funds. The upcoming Voltaire era will shift full governance on-chain, and future implementations like Hydra and Midnight will address scalability and privacy issues.

- Stock Market Analogy: Cardano is the Crypto Mutual Fund SIP—boring in the short term, but delivering compounded wealth in the long term.

- Risk Profile: Low to Medium. Slow development pace is the primary risk.

| Keywords for Cardano | ||

| Cardano ADA price prediction | Charles Hoskinson philosophy | Cardano Voltaire era |

| ADA real-world use cases Africa | Cardano peer-reviewed development | Project Catalyst funding |

3. Solana (SOL): The Lightning-Fast Growth Stock

If Cardano is the professor, Solana is the racer. Known for being a lightning-fast blockchain, Solana handles thousands of transactions per second (TPS) with near-zero fees. Its rapid ecosystem growth and user-friendly wallets like Phantom have made it a favorite among younger users.

High-Speed Ecosystem and Volatility

The Solana ecosystem is active with numerous DeFi protocols and has even become a cultural hub for popular meme coins like BONK and WIF.

In the past year, SOL has demonstrated explosive growth, delivering returns far exceeding the market average. However, this growth comes with volatility. Network outages have historically been a major challenge, though recent version updates aim to stabilize the system.

- Stock Market Analogy: Solana is a Mid-Cap Growth Stock (like Infosys in the 2000s or Zomato)—when it runs, it’s a rocket; when it drops, it’s an elevator.

- Risk Profile: High. Highly volatile with occasional stability risks.

| Keywords for Solana | ||

| Solana TPS speed | SOL price history 2024 | Phantom wallet tutorial |

| Solana network outages fix | Solana vs Ethereum comparison | High risk high reward crypto |

4. Binance Coin (BNB): The Blue-Chip Exchange ETF

The BNB coin is the backbone of the entire Binance Ecosystem, powering the Exchange, Binance Smart Chain, Decentralized Finance (DeFi), and staking activities. Its utility is massive, integrating over 1400 active Dapps like PancakeSwap and Venus.

Utility, Liquidity, and Future Focus

[Image symbolizing the Binance Ecosystem: a hub connected to Exchange logos, DeFi protocols, and staking]

BNB has demonstrated remarkable growth, turning a price of around $188 in 2023 into over $1100 today, showcasing its resilience as an exchange coin.

The future roadmap focuses on becoming a modular blockchain with high interoperability, allowing Ethereum applications to easily migrate to the Binance chain. The unparalleled liquidity of the Binance ecosystem further solidifies BNB’s position.

- Stock Market Analogy: BNB is a Blue-Chip ETF—stable, highly liquid, and backed by a global industry leader.

- Risk Profile: Medium to High. The primary risk is regulatory scrutiny on the parent company, Binance, which could lead to significant crashes.

| Keywords for Binance Coin | ||

| BNB coin utility | Binance Smart Chain Dapps | BNB regulatory risks |

| PancakeSwap on BNB Chain | BNB price prediction long term | Exchange coin investment |

5. Mega Comparison Table: Crypto vs. Traditional Assets

Here is a comparison of these three reliable altcoins against conventional investment vehicles to help you define your crypto investment strategy.

| Asset Class | Crypto Example | Risk Profile | Return Potential | Investment Strategy |

| Mutual Fund | Cardano (ADA) | Low to Medium | Medium | Long-Term SIP, Discipline |

| Growth Stock | Solana (SOL) | High | High | Volatility Trading, Growth |

| Blue-Chip ETF | Binance Coin (BNB) | Medium to High | High | Stability, Ecosystem Growth |

| Stocks (Large Cap) | N/A | Medium | High | Diversified Portfolio |

| Gold | N/A | Low | Low (9-10% historical) | Inflation Hedge, Safety |

| Silver | N/A | Medium to High | Volatile | Commodity Play, Industrial Purpose |

Conclusion and Portfolio Strategy

The key to successful crypto investing is applying the same discipline used in mutual funds.

- Foundation: Bitcoin and Ethereum should form the base of your portfolio.

- Altcoin Allocation: Reliable altcoins like ADA, SOL, and BNB should not exceed 20-30% of your total portfolio.

- Use Cardano for long-term foundational holding.

- Use Solana for growth and high-potential returns.

- Use BNB for stability and ecosystem exposure.

Remember: the market operates on fundamentals, not noise. Always conduct your own thorough research before making any investment decision.

💡 Additional Keywords for SEO

- reliable altcoin list 2026

- best cryptocurrency to buy now

- Cardano Solana BNB comparison

- crypto investment for beginners

- altcoin vs mutual fund strategy

- why ADA is a good long term investment

- Solana vs Cardano performance

- understanding crypto liquidity

- regulated crypto exchanges India

- crypto portfolio diversification tips